While the Covid-19 epidemic is spreading all around the world, China is now seeing some significant improvements and situation in China has become much more positive than in the rest of the world. However, the coronavirus is having a strong impact on the Chinese consumption. Furthermore, it will have a long lasting impact on how they will spend their money in the coming months.

Chinese Consumption Survey - March 2020

To better understand Chinese consumption behaviors, we reviewed a survey realized by Deutsche Bank among a panel of 600 Chinese citizens. The survey explores how the virus has impacted their consumption, their spending patterns and what they plan to buy when the situation resumes to a “new normal”.

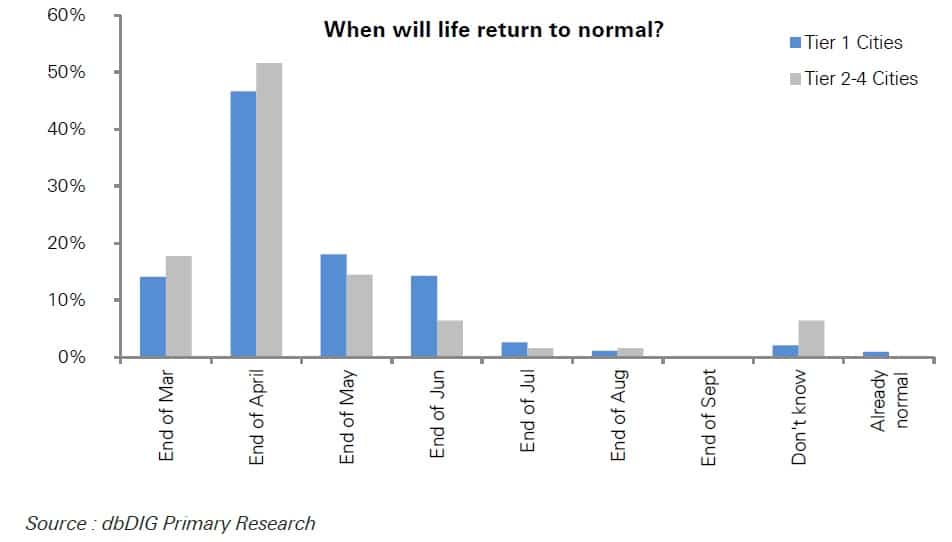

First, on the perspective of a return to normality, most Chinese people see this happening around the end of April. However, the larger cities (Tier-1) residents are being more cautious.

In a reflection to geography, high-income households are more concerned about the Covid-19 being an issue beyond the next 3 months than others.

A strong impact on travelling and luxury

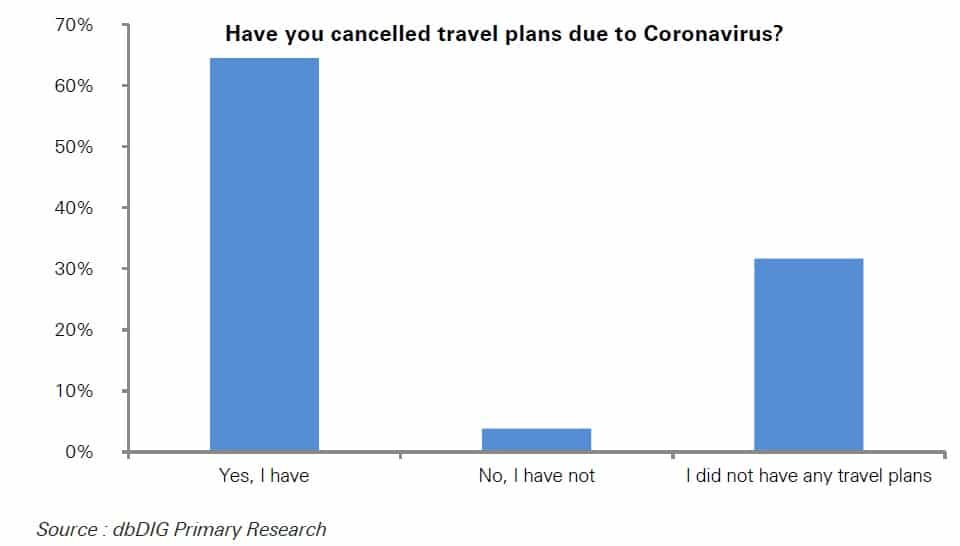

This difference can be explained by the relationship with travelling. At this moment, 65% of the Chinese surveyed have already canceled future travels plan. And it reaches 90% for the highest income bracket. At this point, only 21% of Chinese still have travelling plans; and among them, over 60% plan to cancel their travel.

As such, one of the lasting effect of the crisis will be on travelling, especially with the situation worsening outside of China.

In the meantime, luxury brands will be directly impacted by this drop of Chinese travelers, as a significant amount of luxury items are bought outside of China.

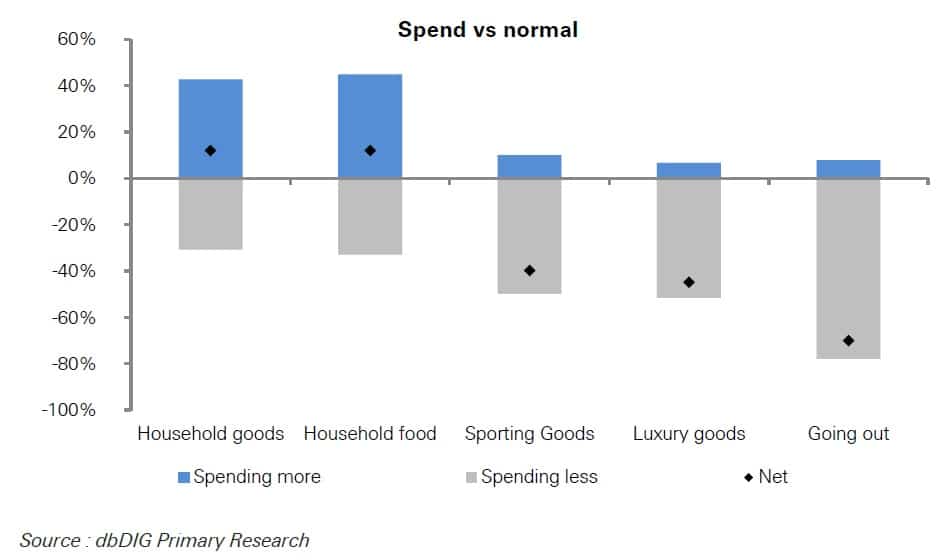

During the crisis, Chinese have focus their spending on household goods.

However, around one third of the respondents did shop for luxury online over the last months and it even grows to 46% for millenials, and up to 60% for the highest income bracket who also favors online to physical stores.

Perspective on spendings and impact on e-commerce

As for luxury, Chinese are favoring online shopping and e-commerce, even more than before the crisis.

Discover the best e-commerce websites in China

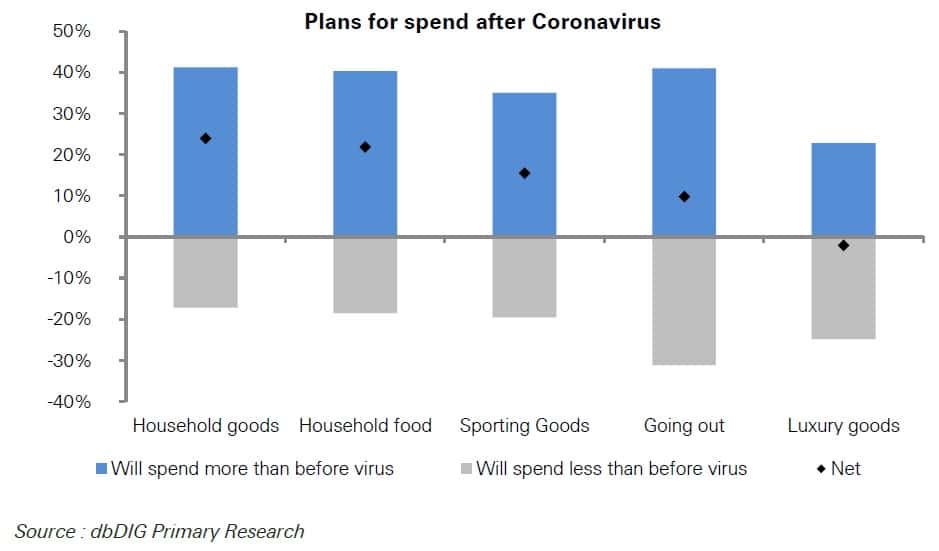

The Chinese population seems to be rather cautious about future spendings. They plan only to spend a “little” of what they have saved during the crisis.

Chinese highest income bracket plans to spend more after the crisis. Among those who plan on spending more, a vast majority will spend money on experiences; and one third plans to spend on luxury.

Next Ren is a digital marketing agency in Shanghai with a strong e-commerce experience.

Follow us on LinkedIn and WeChat to stay updated on China Digital Marketing trends.